An alternative for future funding and improved performance of the U.S. transportation system

Bringing together government, business, academic, and transportation policy leaders to conduct education and outreach on the potential for mileage-based user fees.

2024 MBUFA National Conference

Download the presentations from the 2024 Conference at the link below.

WHO WE ARE

The Mileage-Based User Fee Alliance

Formed in 2010, the Mileage-Based User Fee Alliance (MBUFA) is a national non-profit organization that brings together government, business, academic, and transportation policy leaders to conduct education and outreach on the potential for mileage-based user fees as an alternative for future funding and improved performance of the U.S. transportation system.

The sustainability of the current transportation funding system is in doubt.

As a research and educational organization, MBUFA’s primary goals are to:

Create a constructive learning environment and policy space for collaboration and networking among individuals and groups interested in mileage-based user fees

Coordinate efforts to build awareness of mileage-based user fee programs in the US and around the world

Promote research to test the feasibility of mileage-based user fee programs

Engage community and political leaders around common priorities for transportation funding

The sustainability of the current transportation funding system is in doubt.

As a research and educational organization, MBUFA’s primary goals are to:

Create a constructive learning environment and policy space for collaboration and networking among individuals and groups interested in mileage-based user fees

Coordinate efforts to build awareness of mileage-based user fee programs in the US and around the world

Promote research to test the feasibility of mileage-based user fee programs

Engage community and political leaders around common priorities for transportation funding

MILEAGE-BASED USER FEE ALLIANCE

What It Is

A mileage based user fee (MBUF) or vehicle miles traveled (VMT) fee is a user charge based on miles driven in a specific vehicle as opposed to the current excise tax on fuel consumed.

At its simplest, the fee would be cents per mile. More sophisticated systems could assess different mileage fees based on factors like location, congestion, emissions, and type of vehicle.

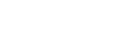

Policymakers are looking for ways to improve how to pay for our transportation system because the current funding system, based primarily on the federal and state excise tax on gasoline and diesel fuel as documented by the National Transportation Policy and Revenue Study Commission and others, is becoming obsolete due to reduced gasoline consumption and more fuel-efficient vehicles.

A mileage based user fee (MBUF) or vehicle miles traveled (VMT) fee is a user charge based on miles driven in a specific vehicle as opposed to the current excise tax on fuel consumed.

At its simplest, the fee would be cents per mile. More sophisticated systems could assess different mileage fees based on factors like location, congestion, emissions, and type of vehicle.

Policymakers are looking for ways to improve how to pay for our transportation system because the current funding system, based primarily on the federal and state excise tax on gasoline and diesel fuel as documented by the National Transportation Policy and Revenue Study Commission and others, is becoming obsolete due to reduced gasoline consumption and more fuel-efficient vehicles.

MILEAGE-BASED USER FEE ALLIANCE

How Does It Work?

There are many potential technologies for operating a mileage-based system and it is possible that offering options may be most effective for implementation. There are some fundamental criteria that all systems must meet to ensure acceptance and functionality.

Systems need to be fair, easy to use, accurate, and efficient in collecting payment and the information collected must be kept private.

MILEAGE-BASED USER FEE ALLIANCE

How Does It Work?

There are many potential technologies for operating a mileage-based system and it is possible that offering options may be most effective for implementation. There are some fundamental criteria that all systems must meet to ensure acceptance and functionality.

Systems need to be fair, easy to use, accurate, and efficient in collecting payment and the information collected must be kept private.

MILEAGE BASE USER FEES

Technologies

Odometer

The simplest system would be to measure miles traveled by periodic odometers readings and to assess fees based on that data.

GPS Systems

They create the most concern about privacy but they also offer the most advanced data collecting capabilities for not just reporting the distance traveled but the type of road.

On Board Units

This technology would enable the electronic gathering of mileage measurements by simply plugging into on-board diagnostic ports

Cellular On Board Units

Vehicles would use technology installed or as part of an on board unit to measure distance travelled as well as where traveled to compute miles and communicate data.

Smartphone

Smartphones are a lower cost alternative to more expensive, installed equipment. They combine the GPS tracking and the communication vehicle for transferring data to the central billing.

MILEAGE-BASED USER FEE

How Does It Work?

Transportation infrastructure (interstate highways, roads, and bridges and capital for transit systems) in the United States is funded primarily by an indirect user fee, specifically at the Federal level by the 18.4 cents/gallon excise tax on gasoline and the 24.4-cent tax on diesel fuel. States have their own fuel taxes.

These revenues go into the Federal Highway Trust Fund or a similar state fund.

The gas tax at the Federal level is not indexed to inflation, and since the last time it was raised nearly 20 years ago in 1993, its purchasing power has substantially declined.

Given the continued increases in fuel efficiency and the introduction of alternatively fueled vehicles, including hybrid and electric vehicles, the revenue generated will continue to decline significantly. In fact, it already has.

Transportation infrastructure (interstate highways, roads, and bridges and capital for transit systems) in the United States is funded primarily by an indirect user fee, specifically at the Federal level by the 18.4 cents/gallon excise tax on gasoline and the 24.4-cent tax on diesel fuel. States have their own fuel taxes. These revenues go into the Federal Highway Trust Fund or a similar state fund.

The gas tax at the Federal level is not indexed to inflation, and since the last time it was raised nearly 20 years ago in 1993, its purchasing power has substantially declined.

Given the continued increases in fuel efficiency and the introduction of alternatively fueled vehicles, including hybrid and electric vehicles, the revenue generated will continue to decline significantly. In fact, it already has.

UNLEADED GAS TAX

cents per gallon

DIESEL GAS TAX

cents per gallon

UNLEADED GAS TAX

cents per gallon

DIESEL GAS TAX

cents per gallon

The effort to build a user-pays principle to infrastructure improvements—coupled with the search for more stable revenue sources—has led to calls for a mileage-based user fee (MBUF) approach. The biggest merit of MBUF is that it brings us much closer to a user-pay system, by charging drivers directly for the miles they travel and the resulting wear and tear on the roads. It also addresses the declining revenue value of the gas tax.

Transportation infrastructure (interstate highways, roads, and bridges and capital for transit systems) in the United States is funded primarily by an indirect user fee, specifically at the Federal level by the 18.4 cents/gallon excise tax on gasoline and the 24.4-cent tax on diesel fuel. States have their own fuel taxes.

These revenues go into the Federal Highway Trust Fund or a similar state fund.

The gas tax at the Federal level is not indexed to inflation, and since the last time it was raised nearly 20 years ago in 1993, its purchasing power has substantially declined.

Given the continued increases in fuel efficiency and the introduction of alternatively fueled vehicles, including hybrid and electric vehicles, the revenue generated will continue to decline significantly. In fact, it already has.

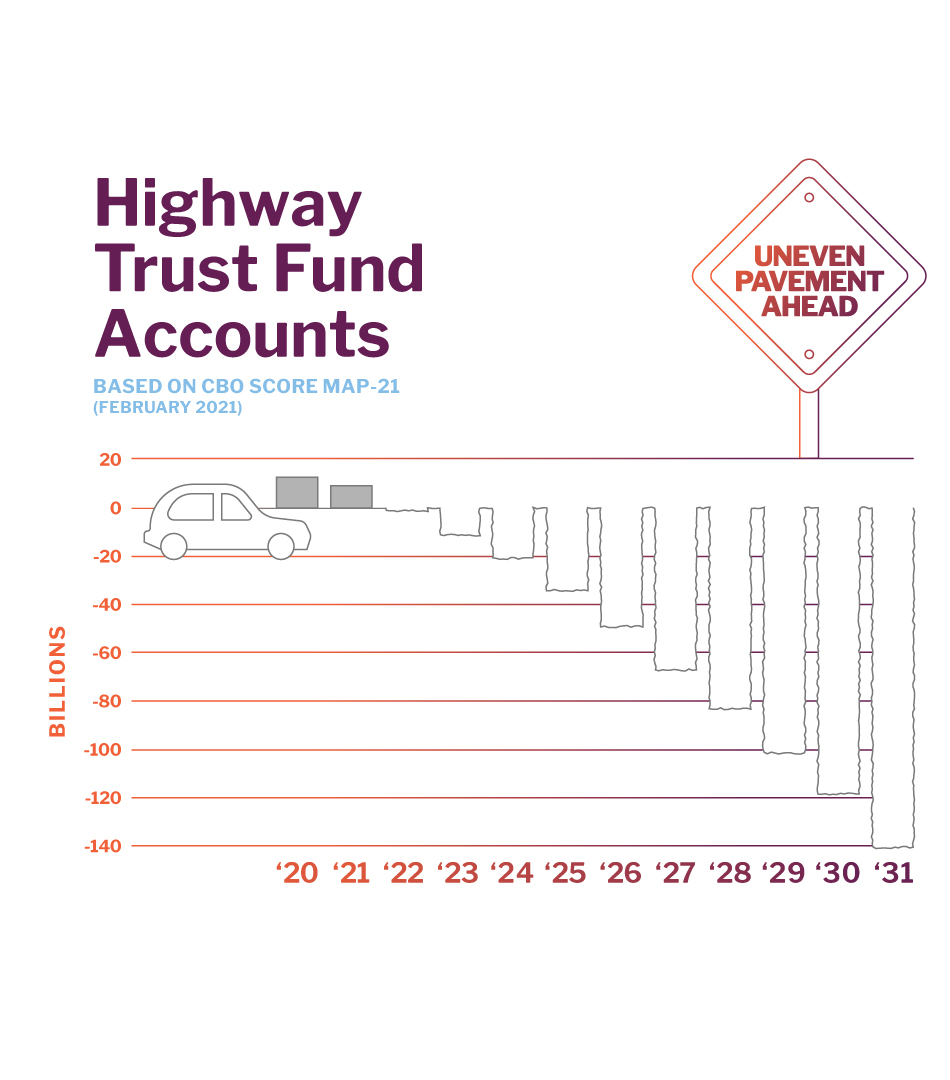

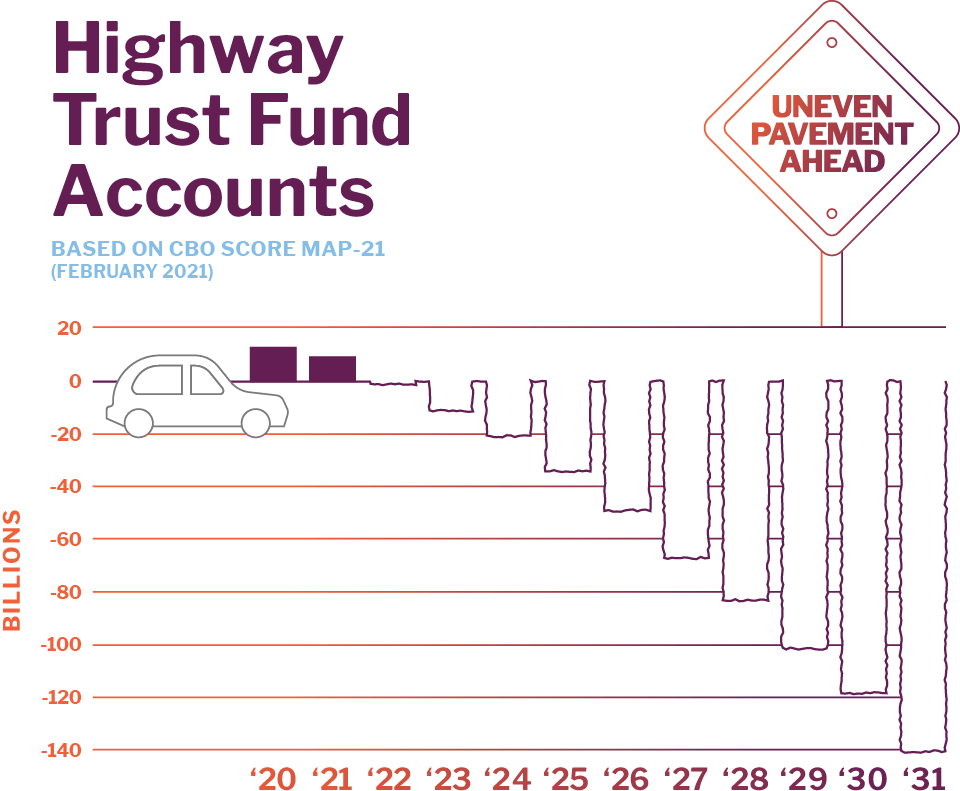

Since 2008, gas tax expenditures have exceeded receipts requiring a transfer of $34.5 billion from the general fund to the Highway Trust Fund to pay the bills.

According to one recent study (American Road and Transportation Builders Association), the new CAFE standards will result in the loss of more than $65 billion in the Highway Trust Fund dollars between 2017 and 2023. A similar study was recently released by Congressional Budget Office.

With increasing gas prices and greater use of energy efficient and alternative fuel vehicles, and the need to maintain at least the current levels of expenditure, the Highway account of the Highway Trust Fund will be insolvent in early 2015 according to the Congressional Budget Office (CBO).

UNLEADED GAS TAX

cents per gallon

DIESEL GAS TAX

cents per gallon

Transportation infrastructure (interstate highways, roads, and bridges and capital for transit systems) in the United States is funded primarily by an indirect user fee, specifically at the Federal level by the 18.4 cents/gallon excise tax on gasoline and the 24.4-cent tax on diesel fuel. States have their own fuel taxes.

These revenues go into the Federal Highway Trust Fund or a similar state fund.

The gas tax at the Federal level is not indexed to inflation, and since the last time it was raised nearly 20 years ago in 1993, its purchasing power has substantially declined.

Given the continued increases in fuel efficiency and the introduction of alternatively fueled vehicles, including hybrid and electric vehicles, the revenue generated will continue to decline significantly. In fact, it already has.

UNLEADED GAS TAX

cents per gallon

DIESEL GAS TAX

cents per gallon

Since 2008, gas tax expenditures have exceeded receipts requiring a transfer of $34.5 billion from the general fund to the Highway Trust Fund to pay the bills.

With increasing gas prices and greater use of energy efficient and alternative fuel vehicles, and the need to maintain at least the current levels of expenditure, the Highway account of the Highway Trust Fund will be insolvent in early 2015 according to the Congressional Budget Office (CBO).

According to one recent study (American Road and Transportation Builders Association), the new CAFE standards will result in the loss of more than $65 billion in the Highway Trust Fund dollars between 2017 and 2023. A similar study was recently released by Congressional Budget Office.

MILEAGE-BASED USER FEE ALLIANCE

Subscribe to Our Newsletter

MILEAGE-BASED USER FEE ALLIANCE

Subscribe to Our Newsletter

BRANDING

Proin facilisis varius nunc. Curabitur eros risus, ultrices et dui ut, luctus accumsan nibh. Fusce convallis sapien placerat.

SEO

Proin facilisis varius nunc. Curabitur eros risus, ultrices et dui ut, luctus accumsan nibh. Fusce convallis sapien placerat.

MARKETING

Proin facilisis varius nunc. Curabitur eros risus, ultrices et dui ut, luctus accumsan nibh. Fusce convallis sapien placerat.

Simple

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque.

Powerful

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque.

Responsive

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque.

Driven by Results

Oshine comes with 25 unique and stunning demos. We have crafted each and every demo with extensive care and precision and the theme is power packed yet easy to use.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur.

ADVERTISING

Proin facilisis varius nunc. Curabitur eros risus, ultrices et dui ut, luctus accumsan nibh. Fusce convallis sapien placerat.

MOBILE APPS

Proin facilisis varius nunc. Curabitur eros risus, ultrices et dui ut, luctus accumsan nibh. Fusce convallis sapien placerat.

PR

Proin facilisis varius nunc. Curabitur eros risus, ultrices et dui ut, luctus accumsan nibh. Fusce convallis sapien placerat.

“I recommend this theme to all my clients. The people at Brand Exponents have excellent taste and the support is top-notch. They are always patient and helpful and really this is the only theme you will need. The page builder is so easy and the theme also comes with excellent demo data that you can tailor to your own needs. Perfect in every way.